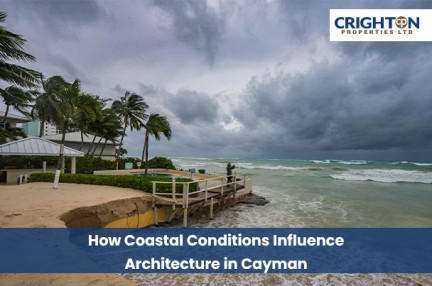

How Coastal Conditions Influence Architecture in Cayman

Discover how coastal conditions in the Cayman Islands shape architectural design, from hurricane resistance to ventilation and elevated foundations.

Crighton Properties | March 05, 2024

Single-family homes, luxury estates, townhouses, and apartments, countless residential properties are listed on the market for sale, yet, condominiums emerge as a favored housing choice, attracting potential buyers with their contemporary yet sustainable design, artisan craftsmanship, and a world of benefits.

Curious to know the perks of owning a condominium? Dive deep with us, and we promise you will call a condominium your next dream home by the end of this journey.

Starting from the top, low maintenance is the primary advantage of owning a condominium. Unlike luxury real estate, duplexes, villas, single-family homes, and detached houses, where the property maintenance, including interiors as well as exteriors such as staircases, corridors, landscaping, and other common areas is the owner’s responsibility, the maintenance of a condominium is typically taken care by the condominium association.

Condos are ideal for potential owners with active or laid-back lifestyles, as they are free from the burden of handling such tasks.

Whether you are a first-time buyer or have financial constraints, a condominium springs out as an affordable option compared to independent homes or luxury properties, as a variety of them are well equipped with modern furnishings such as sofas, beds, chairs, & storage units, state of the art appliances like dishwasher, microwave, washer & dryer, and decorative elements, including artwork, rugs, curtains, lighting fixtures, and aesthetically pleasing accents.

Additionally, condos are sold at a lower value and have flexible maintenance costs, grabbing the attention of a broader range of buyers.

Owning a condominium equates to hitting a jackpot of facilities, literally! Apart from securing a fully furnished property, you also gain access to an array of amenities such as outdoor swimming pools or spas, fitness centers, clubhouses, lounges, recreation rooms, courtyards, terraces, tennis courts, gardens, rooftop decks, and business centers.

And the list doesn’t end here!

Numerous condos extend concierge services like package delivery, transportation & running personal errands, and pet amenities such as pet washing stations and pet care services.

Another advantage of buying a condo is you, your loved ones, and your belongings are protected under the supervision of vigilant security personnel with features like gated entry, 24/7 surveillance cameras, and security patrols.

Additionally, residents have complete authority to access the system anytime and anywhere, ensuring safety and peace of mind.

As previously mentioned, most condos are fully furnished, making the move a smooth transition. Neither do you have to worry about transporting nor arranging the furniture; just carry the essentials, and you are all set to sit back and relax in your picture perfect home.

Further, ready-to-move-in condos are excellent for potential homeowners in pursuit of immediate possession with minimum experience in interior decorating.

Purchasing a condominium, especially in Cayman, grants you the opportunity to enter into a vibrant and welcoming community where neighbors create a sense of belonging with their warm embrace. The Islands are enveloped with friendly residents eagerly awaiting to welcome you with their hospitality and genuine warmth.

With Cayman Islands condos for sale, you are not merely turning your dreams into reality but also immersing yourself in the sea of lasting bonds, enhanced lifestyle, and unparalleled hospitality that will redefine your living experience.

Apart from the elevated life, living in Cayman is like escaping to a wonderland of dreams. From world-class thrills like scuba diving in the turquoise waters and swimming with the Stingrays to international and local culinary cuisines such as Conch Stew, Jerk Chicken, Seafood Rundown, and Cassava Cake, Cayman has everything that will make you feel every day is a perpetual vacation.

One of the many rewards of purchasing a condominium in Cayman or any region around the world is that they are positioned in the heart of a location, providing close access to prime amenities such as schools, markets, restaurants, and shopping malls.

You don’t have to drive miles away or be seated to significant traffic delays. All the essentials are available within walking distance. From daily groceries to entertainment venues, commuting for everyday needs becomes enjoyable and convenient.

When it comes to the management of Condominiums, associations not only perform routine checks and care for the property but also stand by your side for any concerns you may raise.

The condominium association appoints a professional property management company for each complex and its residents who oversee the administration and resolve issues such as overdue or improper repairs, challenges in the governing rules, conflicts with (HOA) Homeowners Association) under your jurisdiction, resale restrictions, insurance coverage, and similar matters.

Tips Before Investing in a Condominium

FINAL THOUGHT

So far, we discussed the benefits of purchasing a condominium, including minimal maintenance, low cost, facilities & features, and security. Followed by locality, instant occupancy, inviting locals, and professional management with 8 pro tips for informed decision making and successful investment.

It is advisable to consult real estate experts, particularly if you are a beginner in navigating this ever evolving landscape, as their invaluable insights on marketing trends, property valuations, negotiation skills, legal knowledge, and years of experience in the field can help you fulfill your home ownership goals seamlessly.

Discover how coastal conditions in the Cayman Islands shape architectural design, from hurricane resistance to ventilation and elevated foundations.

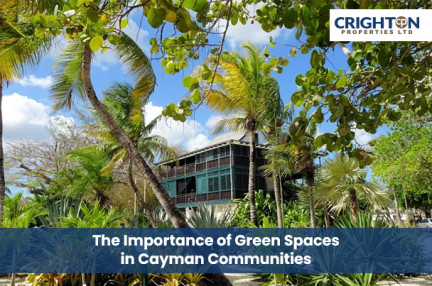

Discover why green spaces are essential in Cayman communities, enhancing property values, well-being, and sustainable urban development.

Discover smart renovation ideas that increase your Cayman property value, attract buyers, and maximize ROI in today’s competitive real estate market.