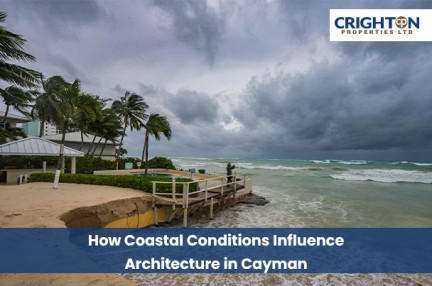

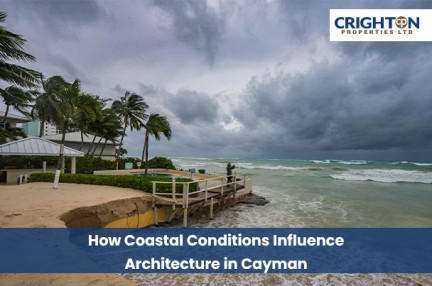

How Coastal Conditions Influence Architecture in Cayman

Discover how coastal conditions in the Cayman Islands shape architectural design, from hurricane resistance to ventilation and elevated foundations.

Crighton Properties | January 14, 2022

Island living holds tremendous appeal to nature and beach lovers alike, and anyone looking to escape the noise of a large and bustling city.

So if you have a penchant for the untouched, a property in Grand Cayman in the Cayman Islands will complete the idyllic picture you probably have in mind. But before you hop on a plane and get yourself one of those Grand Cayman Island homes for sale, we recommend you read this first.

Homes for Sale in the Cayman Islands, particularly in Grand Cayman, one of the three islands in the Cayman Islands territories, provide a rare combination of peace and a cosmopolitan vibe.

When you buy a home in Grand Cayman, you’re not only buying a property, you’re also buying everything that this beautiful island represents. Indeed, a vacation home in this paradise is worth considering.

In fact, it’s certainly recommended if you plan on staying for long periods as renting could cost you more in the long run.

Fortunately, foreigners can buy property in the Cayman Islands. Foreign ownership of real estate is not restricted. There are also no annual property and capital gains taxes to complicate your purchase.

The Land Registry office in Cayman makes transfers of titles reasonably simple. Also, you can easily access and verify all information related to the property you intend to buy because the Land Registry, to protect ownership and rights to privately owned land and houses, keeps all records of property including liens, ownership interests, easements, and restrictions, among others.

When buying homes in the Cayman Islands, you either hire a real estate agent from the get-go or you get your mortgage pre-approved first.

There are advantages and disadvantages to both options but the key point you need to consider is that a qualified real estate company can help you close a mortgage although they sometimes prefer you come to them with a pre-approval already if only to make sure your time and theirs are not wasted.

The choice is ultimately up to you. Below, we’ve mapped out the steps you can take when buying a real estate property in Grand Cayman.

A buyer may choose to work with a real estate company which is a member of CIREBA or a non-CIREBA company. The Islands' MLS (Multiple Listing Service) is managed by the Cayman Islands Real Estate Brokers Association, or more commonly known as CIREBA, which ensures the best market coverage for seeing all properties on all three islands. Should you choose to work with a real estate company which is a member of CIREBA, there’s really no need to use different agents once you’ve found the one you're comfortable with.

In the Cayman Islands, the agents will show you all the listings regardless of with whom they are listed. Because of this, jumping from one agent to another is not necessary.

It’s also wise to hire a real estate company sooner rather than later because they can guide you through the process of buying (or selling) property in Grand Cayman.

A real estate agent is an important aspect of the home-buying process, and you want to be sure it's a good match. Speak to a few different agents to see how they will go about assisting you in finding a property and negotiating a deal on your behalf.

Determining how much the bank will lend you will help you narrow down your choices and speed up your buying process.

A real estate company in the Cayman Islands can recommend local banks to walk you through the mortgage application process.

Depending on the bank, the mortgage approval procedure can take up to six weeks.

Depending on the area in which you are purchasing and the degree of stamp duty it attracts, a basic rule of thumb is to allocate an additional 10% to 12% of the purchase price for closing costs.

Apart from the down payment, upfront costs will include mortgage Stamp Duty, property Stamp Duty, and legal fees.

You'll need funds to cover the Stamp Duty charge on your loan amount. The government levies 1% on loans of less than CI $300,000, and 1.5 percent on loans of more than CI $300,000.

The stamp duty rate is set at 7.5 percent. This tax is applied to the higher purchase price or the surveyor's property appraisal. However, if you’re a first-time buyer in the Cayman Islands, you’re eligible for a stamp duty exemption.

Remember to set aside 0.5 percent to 1% of the overall property purchase price for additional legal fees as well.

If you want to learn more about fees and financing, we wrote a similar article here. The article will also give you an idea what it’s like living in the Cayman Islands.

Here at Crighton Properties, we can help you find the best location for your lifestyle and budget. As a Cayman Islands real estate expert with knowledge of the local property market, we’ll be able to quickly narrow the field for you, so that you don't waste time looking at properties that don't meet your needs.

We can also give you up-to-date information on recent sales, and invaluable advice on how close the list price of a property is to a realistic market value so you can work within your budget and achieve your goals.

All bids are made in writing usually using a standard CIREBA Offer to Purchase document or an offer drafted by a lawyer that allows the buyer to specify the purchase price, deposit, conditions to which the offer is subject and the desired closing date. The document is executed and becomes a legally binding contract once both parties have agreed on a price and terms.

You may want to hire an attorney before signing the CIREBA Offer to Purchase. Your lawyer will analyze the contract terms and advise you on factors you need to consider.

Once all the conditions have been met, the offer to purchase becomes unconditional, and both parties can proceed to closing.

If bank financing is used, the closing will normally take place at the bank, with the buyer signing the relevant mortgage documents before closing. If no bank financing is used, the closing will normally take place at the attorney's office of either the vendor or the buyer.

Both parties will sign a Transfer of Land Form RL1. The transaction is completed when the final proceeds due to the Vendor at closing is paid and the fully executed Transfer of Land Form is given to the Purchaser.

Get in touch with us! Crighton Properties is one of the most trusted CIREBA-certified real estate companies in the Cayman Islands. We offer a range of real estate services for both buyers and sellers and excel at providing great customer service.

We can help you find the best vacation home so you can start living your dreams in Grand Cayman! With beautiful landscapes and the sound of white-capped waves crashing on sands, our Properties for sale in Grand Cayman can easily eclipse the highest and grandest of your dreams, as only the rumbling ocean of the Cayman Islands can do.

Discover how coastal conditions in the Cayman Islands shape architectural design, from hurricane resistance to ventilation and elevated foundations.

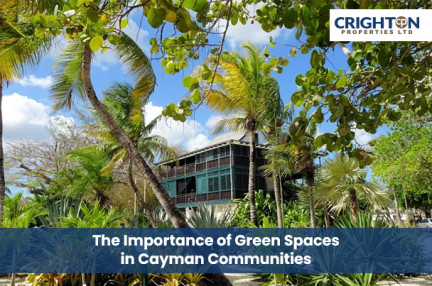

Discover why green spaces are essential in Cayman communities, enhancing property values, well-being, and sustainable urban development.

Discover smart renovation ideas that increase your Cayman property value, attract buyers, and maximize ROI in today’s competitive real estate market.