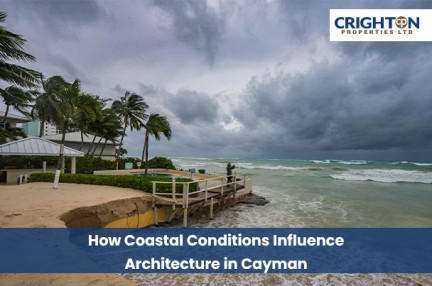

How Coastal Conditions Influence Architecture in Cayman

Discover how coastal conditions in the Cayman Islands shape architectural design, from hurricane resistance to ventilation and elevated foundations.

Crighton Properties | March 07, 2024

Planning your finances is the initial step to purchasing a home in Cayman. However, first-time buyers often cannot comprehend the full scope of expenses. Many assume that buying a residential property only includes the procurement value when, in fact, multiple costs are involved to ensure a seamless transaction.

Continue reading this write-up as we guide you on preparing financially for buying your first home in the islands.

Assessing your finances is the primary aspect of understanding your financial standing. Usually, evaluating economic health includes your earnings, spending, savings, and debts, which helps to gauge how much you can practically invest in purchasing a home.

As mentioned above, acquiring a home comprises a variety of costs and fees, such as -

Hence, it is important to measure these associated costs as they will help in mapping out how much funds you have to set aside for buying a home without having to compromise on your fundamental requirements and to seamlessly manage emergencies like upsizing or downsizing in the family or changing jobs.

Do search for mortgage options for buying a Cayman Islands homes for sale. Researching different banks and their mortgage plans allows you to compare the interest rates & terms, understand costs & fees, and prepare for pre-approval.

The islands have a variety of local and notable banks such as Butterfield Bank, CIBC FirstCaribbean, Cayman National Bank, Scotiabank & Trust (Cayman) Ltd, and more, offering 20 to 35 years mortgage terms, varying from 1% to 5% competitive interest rates, which allows you to opt a repayment plan fitting to your economic capacity.

It is suggested that you explore diverse alternatives and choose the one that goes hand in hand with your needs.

One of the common mistakes homeowners make is that they dive straight into the house-hunting process before getting pre-approval for the mortgage. Skipping the pre-approval part often leads to discouragement and regret since they couldn’t secure their dream retreat due to the lack of capital.

To avoid this situation, obtaining pre-approval is recommended as it is a green flag that not only sets realistic expectations and empowers you to lay the foundation of a successful & fulfilling real estate transaction but also eases up your transition to the new home.

Focus on saving a substantial amount for the down payment. Reserving a large sum simplifies the lending journey, as you don’t have to borrow a huge amount from the lender, eventually reducing debt acquisition and interest rates.

Further, smaller loans are more likely to be approved than large ones. Banks tend to consider large loans risky because the borrower has a sizable equity in the property compared to the lender. Hence, it is advised to preserve a significant amount for a down payment to showcase your financial stability and dedication towards repaying the debt in the predetermined time.

Banks in Cayman typically ask for a 10% to 15% down payment for residential properties based on the loan applicant’s job stability, income, current position in the organization, etc.

While Cayman does not have any criteria for analyzing credit history, banks still review it as one of the essential aspects of the loan approval process. Generally, banks gather credit reports and review past and present credit accounts, timely payments of the borrower’s previous loans & credit accounts, existing outstanding debts, and plausible opposing remarks such as bankruptcy.

Lenders also consider the length of the credit history. A longer and positive credit history is one of the endorsing factors that increases the likelihood of loan authorization.

Another prerequisite of financial planning for Cayman real estate is saving emergency funds. Much like dedicating funds for purchasing a home and additional expenses, saving emergency funds is imperative to ensure you are prepared for potential and unexpected circumstances like home maintenance, repairs, renovations, medical illness, natural disasters, and family expenses.

Here are some ideas to save funds for unforeseen predicaments -

Last but definitely not least is hire a professional and experienced realtor, especially if you are buying a home for the first time. Venturing through the unknown can be challenging and overwhelming, but an expert agent can streamline the approach.

They not only help you unravel a range of properties suiting your criteria but also manage the documentation & legalities, present counteroffers on your behalf, handle the contract & closing, and coordinate inspections and appraisals while you sit, back, relax, and concentrate on other important commitments and activities.

WRAP UP

Before we draw to a conclusion, here is a quick recap of the key points for financially preparing yourself to buy a home in Cayman for the first time.

So far, we discussed -

Take these tips into account for informed decision-making and facilitating an effortless buying experience. Always remember to be patient and flexible in your endeavors. A wise man once said, “Don’t rush the process. Good things take time.

Discover how coastal conditions in the Cayman Islands shape architectural design, from hurricane resistance to ventilation and elevated foundations.

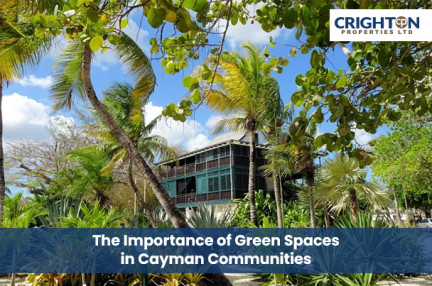

Discover why green spaces are essential in Cayman communities, enhancing property values, well-being, and sustainable urban development.

Discover smart renovation ideas that increase your Cayman property value, attract buyers, and maximize ROI in today’s competitive real estate market.