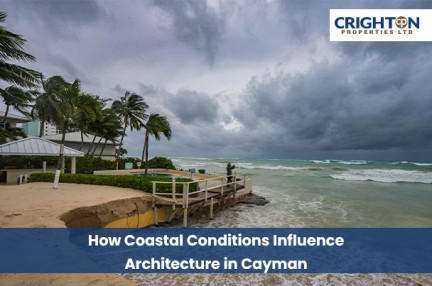

How Coastal Conditions Influence Architecture in Cayman

Discover how coastal conditions in the Cayman Islands shape architectural design, from hurricane resistance to ventilation and elevated foundations.

Crighton Properties | December 23, 2025

The Cayman Islands have long been associated with postcard-perfect beauty, but smart investors understand that these three little islands are more than just white beaches and azure oceans. In 2026, the focus will move from "Is Cayman attractive?" to "What kind of returns, stability, and long-term value can I realistically expect here?" This blog examines the opportunity side of the tale without disregarding the actual issues that influence returns.

Cayman’s fundamentals start with stability. It is a British Overseas Territory with a well‑regulated financial sector, a long history of welcoming international investment, and a legal system based on English common law. For property buyers, that translates into clear title, strong protection of ownership rights, and a relatively smooth transaction process compared to many other tropical markets.

The second pillar is its tax‑neutral environment. There is no direct income tax, capital gains tax, or inheritance tax on property. For long‑term investors, this means that what the market gives you in appreciation or rental income is not heavily eroded by domestic taxation, subject of course to your own home‑country rules.

Lifestyle demand is the third major driver. Cayman offers high‑quality infrastructure, international schools, modern healthcare, and year‑round tourism. That combination attracts expatriate professionals, high‑net‑worth individuals, and families looking for second homes or relocation options.

Cayman's property values have steadily increased over the last decade, with years of high development followed by periods of stabilization. After strong post-pandemic demand and rising building costs pushed prices upward, the market has progressively recalibrated. In 2026, expect modest price rises, robust transaction volumes in well-located neighborhoods, and reasonable buyer and seller expectations, rather than spectacular surges.

Waterfront, canal‑front, and beach‑adjacent properties continue to command a premium. Limited supply along iconic stretches like Seven Mile Beach keeps demand high, particularly for turnkey condos and villas. At the same time, there is an active mid‑market segment made up of townhouses, family homes, and inland condos that cater to residents and long‑term renters rather than purely holiday traffic.

Rental demand remains a crucial part of the picture. Cayman’s role as a financial and professional services hub, together with a steady tourism base, supports both long‑term leases and short‑term vacation rentals.

Return on investment in Cayman is shaped by a blend of factors: location, property type, financing structure, and how actively you manage the asset. In 2026, five drivers will matter more than ever:

Even within a small geography, micro‑locations matter a lot. Properties along established high‑demand corridors tend to see stronger capital appreciation and lower vacancy rates. Areas that combine lifestyle, day‑to‑day convenience (supermarkets, schools, offices) often deliver the most balanced long‑term performance.

Condos and apartments close to business districts and tourist areas are naturally suited to rental investors. Standalone homes and villas, especially in gated or master‑planned communities, attract end‑users and long‑stay residents. Raw land and development sites can offer strong upside, but timelines are longer and require a clear strategy, professional advice, and a realistic exit plan.

Interest rates affect both affordability and ROI. When lending rates soften, more local buyers and long‑term residents enter the market, supporting transaction volumes in the mid‑range. For investors using leverage, the spread between rental yields and borrowing costs becomes a key metric. A sensible loan‑to‑value ratio helps preserve cash flow even if rents or rates move slightly.

A property in a great location can still underperform if it is poorly managed. Choosing between long‑term leases and short‑term vacation rentals, setting realistic rental rates, maintaining the property, and working with a reliable local property manager can make a meaningful difference to your net returns. Cayman rewards owners who treat their property like a business, not just a holiday home.

Different types of investors will naturally gravitate toward different parts of the market. In 2026, several opportunity clusters stand out.

If consistent rental income is your priority, well‑located condos near the beach, George Town, or key employment areas are worth close attention. One‑ and two‑bedroom units in established developments often have year‑round demand from professionals and couples, and can be easier to keep occupied than very large luxury properties.

Many buyers want a property they can enjoy themselves while also renting it out when they are away. For this group, turnkey villas or townhomes in managed communities are attractive. You benefit from shared amenities, on‑site maintenance, and a setting that appeals both to you and to future guests or tenants.

Investors with a longer horizon may consider canal‑front lots, inland development land in the path of growth, or homes in up‑and‑coming neighbourhoods. Returns here are rarely instantaneous, but as infrastructure improves and the island continues to grow, well‑chosen sites can see meaningful value uplift.

Because Cayman is a premium destination, entry prices can be higher than in some neighbouring jurisdictions. That said, Cayman Islands real estate prices need to be viewed alongside what you receive in exchange: a strong legal framework, quality infrastructure, political stability, and a global reputation that continues to draw high‑value visitors and residents.

Rather than looking only for the lowest price per square foot, investors do well to ask: “What type of tenant or future buyer will this property attract?” and “How resilient is this location if market conditions change?” Well‑selected assets may cost more at the outset but can preserve value better, experience less vacancy, and be easier to exit when it is time to sell.

Navigating any property market from the outside can be challenging, and Cayman is no exception. Regulations, zoning, financing options, and neighbourhood nuances are all easier to understand with grounded local guidance. Experienced real estate agents in the Cayman Islands bring not just access to listings, but also context: which areas are seeing new infrastructure, what types of properties rent fastest, and how best to structure an offer in a competitive segment.

A good local advisor will ask the right questions about your goals, risk appetite, holding period, and exit plan, then guide you toward properties that truly match that profile, rather than simply what is available today.

The story of Cayman in 2026 is about steady, well‑researched decisions that align with your long‑term objectives. If you approach the market with clear expectations, realistic numbers, and the right local support, Cayman Islands real estate investment can play a meaningful role in a diversified portfolio, combining lifestyle value with financial returns.

Whether you are taking your first step into the market or expanding an existing portfolio, the key is to think in years, not months; in quality, not just quantity; and in total return, not only headline yield.

Yes. Many buyers are non‑residents who complete purchases with the help of local agents, attorneys, and lenders.

For many first‑time investors, a well‑located condo or townhouse in an established area can be a practical starting point. These properties are often simpler to finance and manage, and they tend to have a broad rental market among professionals, couples, and small families.

While holding periods always depend on personal goals, many investors plan for at least a five‑ to ten‑year horizon. This allows time for market cycles to play out, for rental income to offset costs, and for the long‑term strengths of the market to reflect in your overall return.

Before investing, understand key terms like Freehold vs Leasehold, Strata/HOA fees, Stamp Duty, Title Registration, Market Value vs Appraised Value, and Rental Yield. These real estate terms help you estimate true costs, ownership rights, and long-term returns.

Discover how coastal conditions in the Cayman Islands shape architectural design, from hurricane resistance to ventilation and elevated foundations.

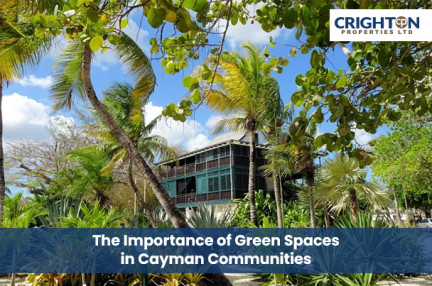

Discover why green spaces are essential in Cayman communities, enhancing property values, well-being, and sustainable urban development.

Discover smart renovation ideas that increase your Cayman property value, attract buyers, and maximize ROI in today’s competitive real estate market.